Market Summary

March 27, 2017

Michael Orr

Journal Columnist

Founder and Owner, Cromford® Report

The market in 2017 has so far continued the trends of 2015 and 2016.

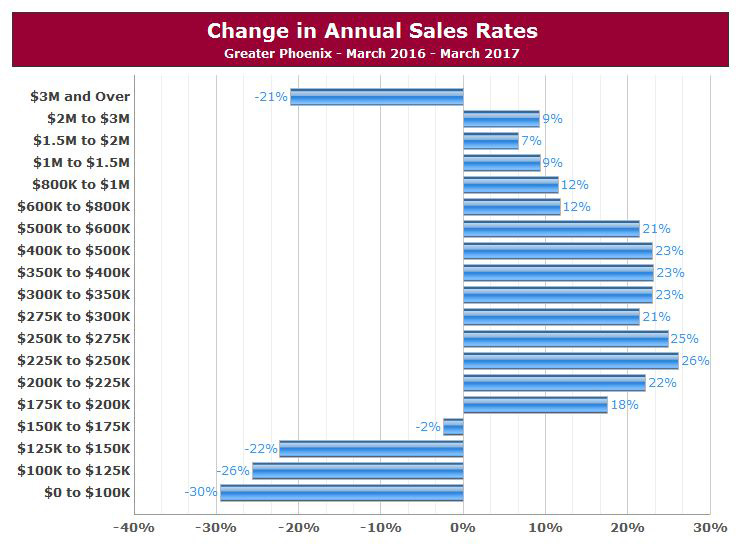

We have very limited numbers of entry level homes and first time buyers face a stressful time unless their budget stretches over $300,000. We have less than 40 days of supply price at $200,000 or less across Greater Phoenix. This is the lowest level since June 2013. With this very low supply, the entry-level segment has been seeing the strongest appreciation, currently running around 8 percent.

Demand has been heating up over the last year between $200,000 and $500,000 and we now have less than 74 days of supply, the lowest level for this price range since the housing bubble in 2005. Until recently supply has been adequate to meet demand, but in some areas it is starting to run low enough to cause problems for buyers. Appreciation for the mid-range has been about 3 percent over the last 12 months.

Once we get over $500,000, buyers have a much easier time. Between $500,000 and $1 million we have 219 days of supply (over 7 months), which is more than adequate to meet the demand. However, this time last year we had 272 days, so sellers are in a better position than they were twelve months ago. It is noticeable that prices are fairly stable in this price range except in the Southeast Valley where they have a lot more momentum.

Between $1 million and $2 million we have 459 days of supply (15 months) and buyers have plenty of choice while sellers have plenty of competition. Although prices rose between 2012 and 2014 for this price range they have been largely stationary for the past 2 years and have fallen in some outer areas a long way from shopping and entertainment districts. Sellers may take some encouragement from the fact that in March 2016 we had 503 days of supply, so at least things have improved for them since then.

In the rarified atmosphere above $2 million, things are rather quiet, surprisingly so, given that the stock market has charged ahead over the past 3 months. Maybe if hopes of tax cuts for corporations and the wealthy come to fruition then we may see more life in the high end market, but at moment this is the only area where sales have not grown over last year. We currently have 927 days of supply (2.5 years) for homes over $2 million, so there is definitely time to shop around for any new buyers coming to the market. Sellers need an enormous amount of patience in this segment unless we are talking about a brand new construction.

Talking of new homes, these continue to grow market share at the expense of re-sale homes, as fashions have changed quite significantly in the last 5 years. Developers face many challenges, however, including a chronic shortage of skilled construction workers and stubbornly high costs for buildable land in the most desirable areas.

With fewer distressed homes than normal, the market is looking healthy, driven primarily by strong domestic migration patterns. The number of people moving to Central Arizona to retire keeps rising and with baby boomers reaching retirement age in growing numbers, this pattern will continue for several years. This is causing the median age in Greater Phoenix to climb significantly. The only cloud on the horizon at the moment is the falling birth rate among the existing population and it looks increasingly likely that natural growth (excluding migration) will turn negative in the not too distant future.