Market Update: Rents and Sale Prices Continue Upward Trajectory July Results for Sales and Listings

September 4, 2019

Fletcher Wilcox

V.P. Business Development & Real Estate Analyst, Grand Canyon Title Agency

July Results

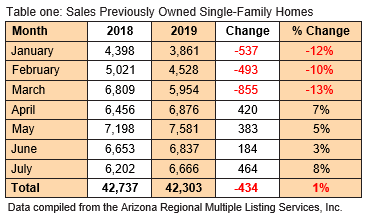

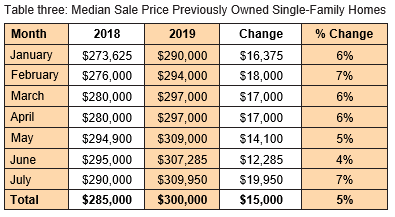

For the fourth consecutive month, year-over-year sales of previously owned single-family homes in Maricopa County were higher. Sales in July 2019 were 464 or eight percent higher than July 2018. New listings of previously owned single-family homes in July 2019 were down 363 or seven percent compared to July 2018. The median sale price for the third consecutive month finished over $300,000. It was $309,950 this July. This was $19,950 or seven percent higher than July 2018.

Trajectory Continues Upward for Monthly Median Rent and Median Sale Price

There are 265,000 previously owned single-family homes that are either a second home or used as a rental in Maricopa County. For those that are rented the monthly median rent hit an all-time high in July 2019. It was $1,745.

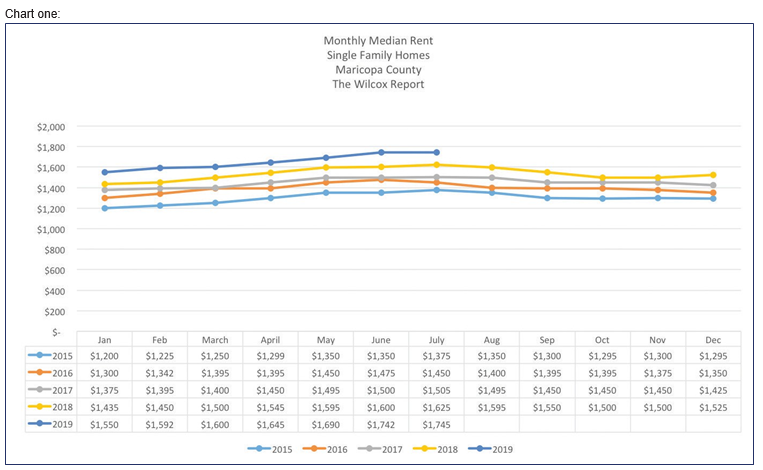

Chart one shows the monthly median rent for previously owned single-family homes in Maricopa County. It starts with January 2015 and continues monthly through July 2019. For each of these years, there is a similar pattern. All five years show January as the month with the lowest monthly median rent for the year. It then continues going up, peaking in either June or July, then dropping in August. December’s median monthly rent is between four and eight percent higher than January of the same year.

Is Thirty-Eight Percent a Magic Number?

Chart two compares the median rent and median sale price for the years 2014 through July of 2019 for previously owned single-family homes. Both have increased each year since 2014 and both have increased by thirty- eight percent from January 2014 to July 2019.

Chart three shows apartment rents for just the first quarters of 2014 through 2019. The rent in the first quarter of 2014 was $783 compared to $1,084 in 2019 for an increase of thirty-eight percent.

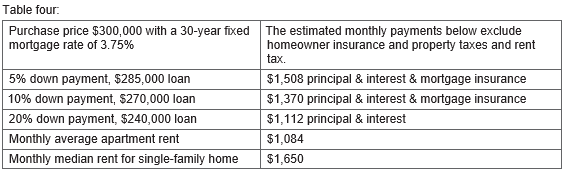

Comparison of a Mortgage Payment to a Rent Payment

The thirty-year fixed mortgage rate in July was close to an all-time low averaging 3.75 percent. With mortgage rates, so low potential buyers may want to consider the purchase of a home. Table four below is an estimate of what a buyer’s monthly mortgage payment might be for principal, interest and mortgage insurance if they purchased a home for $300,000 with down payments of five percent, ten percent, and twenty percent with a thirty-year fixed mortgage rate of 3.75 percent. These monthly payments are compared to a monthly rent payment of $1,650 for a single-family home and a monthly apartment payment of $1,084. Of course, there are other important considerations when considering buying such as how much will be needed for closing costs, what is the cost for home maintenance, etc. This example should be a starting point for potential buyers to consider how much they pay monthly for rent compared to how much they would pay monthly to own. Potential buyers should seek professional advice from a real estate agent and a loan officer.