Market Update: Some Positive Arizona Numbers Going Into the Coronavirus Storm April Sales, Listings, Purchase Price, Estimated Months of Supply

June 1, 2020

Fletcher Wilcox

V.P. Business Development & Real Estate Analyst, Grand Canyon Title Agency

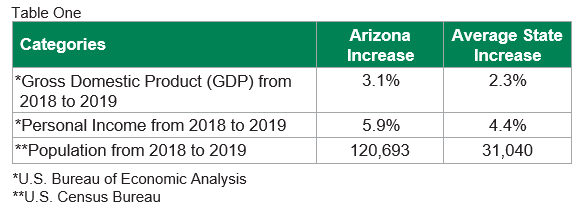

Arizona finished 2019 with some of the best economic and population numbers among all 50 states.

GDP for Arizona in 2019 was 3.1% higher than 2018 and was the seventh-highest percentage increase among all states. The personal income of Arizonians in 2019 was5.9% higher than 2018. Only the citizens of two states had a higher percentage increase in personal income than Arizona. Colorado at 6.1% and Utah at 6.0%. When it came to population growth, Arizona had the third-highest numeric increase of population in the country. Only California and Florida gained more people in 2019. Arizona gained 120,693 people in a one year period. That is 10,000 people per month. So when you add this increase in population to an increase in personal income and an increased GDP, you have the fuel for a tremendous housing market.

GDP for Arizona in 2019 was 3.1% higher than 2018 and was the seventh-highest percentage increase among all states. The personal income of Arizonians in 2019 was5.9% higher than 2018. Only the citizens of two states had a higher percentage increase in personal income than Arizona. Colorado at 6.1% and Utah at 6.0%. When it came to population growth, Arizona had the third-highest numeric increase of population in the country. Only California and Florida gained more people in 2019. Arizona gained 120,693 people in a one year period. That is 10,000 people per month. So when you add this increase in population to an increase in personal income and an increased GDP, you have the fuel for a tremendous housing market.

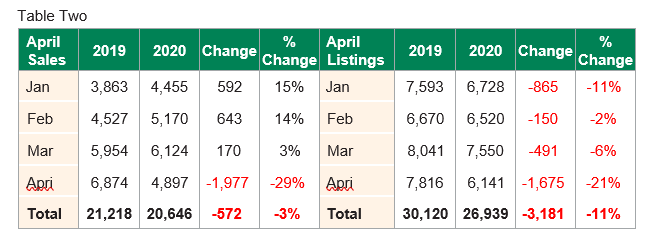

The great Arizona numbers in 2019 led to a great 2020 start for single-family residential resales and single-family dollar sales volume in the largest Arizona County, Maricopa County. Maricopa County residential sales of single-family resales were fifteen percent higher in January 2020 over January 2019 and fourteen percent higher in February 2020 over February 2019. Dollar sales volume for single-family resales in January 2020 was $412,000,000 higher than January 2019 and $515,000,000 higher in February 2020 than February 2019.

Then with all this momentum came the coronavirus storm. No surprise that while the coronavirus storm has slowed sales – it has not stopped sales.

April Results: Sales, New Monthly Listings, Median Purchase Price, Estimated Months of Supply

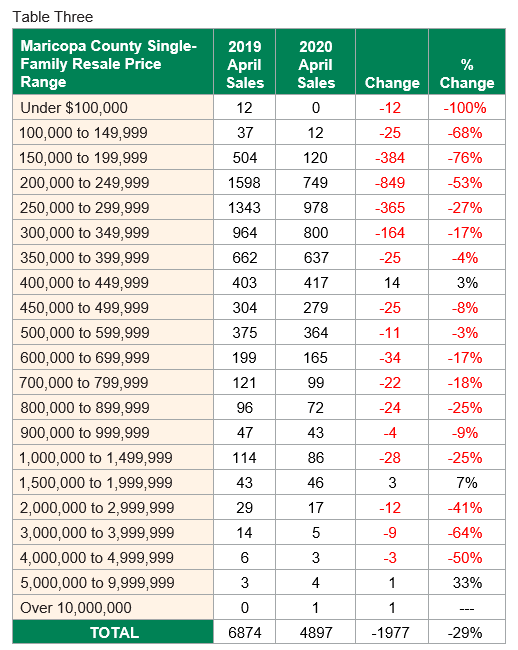

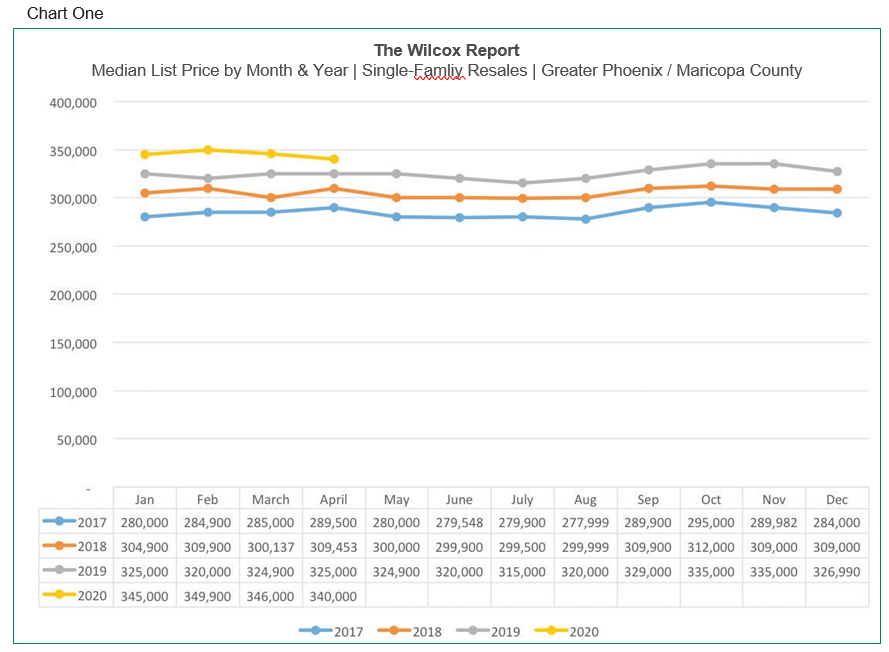

The following information is for single-family resales in Maricopa County compiled from the Arizona Multiple Listing Services, Inc. Closings or sales in April 2020 were down 29% compared to April 2019. See Table Two. When comparing sales by price range, the price ranges that had the largest drop in sales year-over- year were under $300,000, and $2,000,000 and over. Sales from $350,000 to $599,999 had the lowest year-over-year drop. See Table Three. In both April 2019 and April 2020 there were twenty business days in which a sale couldrecord and close. In April 2019 there were 344 closings per business day compared to 245 closings per business day in 2020. New monthly listings in April 2020 were down 21% compared to April 2019. The number of listings per calendar day in April 2019 were 261 compared to 205 per calendar day in April 2020. New monthly listings were already down year-over-year before the coronavirus storm, but not as steep as the April 2020 drop. Estimated months of supply while going up a tad, is still low overall at 1.8 months of supply. The median purchase price in April 2020 took a break after two record setting months. The median purchase price in February 2020 of $327,000 was a new record high only to be outdone by March 2020 when it hit $335,000. The median purchase price in April 2020 was $335,000 tying the previous month. There was a decline in the median list price. The median list price in April 2020 was $340,000 down from $346,000 in March 2020. See Chart One.

Conclusion

While the Coronavirus Storm has certainly slowed sales and listings it has not stopped them. As mentioned earlier, in April 2020 there were 245 closings per business day and 205 listings per calendar day for single-family resales in Maricopa County. There are sellers that still need to sell and buyers that still need to buy. As real estate agents, buyers, and sellers adjust to how we now conduct business, sales can increase. While the following is anecdotal, I want to share recent conversations and experiences. From talking with some lenders, they say after a recent quiet period, there is an increase in buyers wanting to get pre- qualified. Maybe these are potential buyers that previously kept getting beat out deal after deal and now see an opportunity. I also heard that some people in some industries are making more money with increased hours. An agent sent me a contract for a $650,000 purchase in Scottsdale. I had the pleasure to speak with the buyer. He and his wife had downsized a year ago and were now renting. He said they finally found a property they wanted, so they wrote an offer and went under contract. So far, and this is just early into May, I have experienced an increase in purchase openings. This May, the Arizona economy most likely will start to reopen. And maybe, just maybe, not far into the future, we will once again, be at the start of the beginning of a flourishing residential marketplace.