Market Update: Residential Sales and Listings Likely Bottomed in April and May Both Numbers Should Be Up

July 1, 2020

Fletcher Wilcox

V.P. Business Development & Real Estate Analyst, Grand Canyon Title Agency

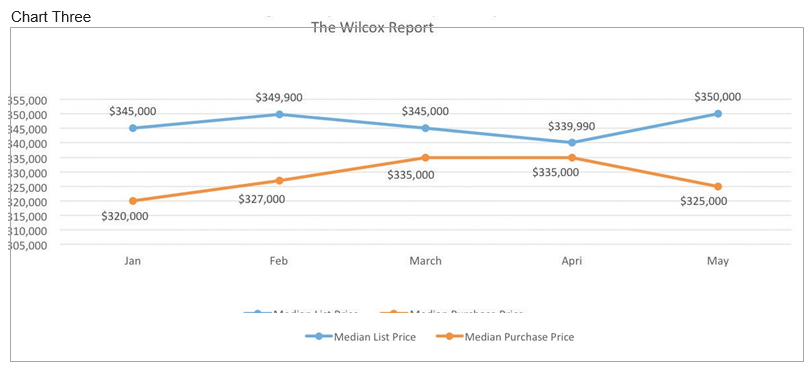

The focus of this article is to discuss the sale, inventory, estimated months of supply, median list price and median purchase price of single-family resales in Maricopa County or Greater Phoenix. The reason for focusing on this category is that data from the Arizona Regional Multiple Listing Services, Inc. (ARMLS), shows that eighty-two percent of sales in May, 4,787 out of 5,866 sales, were single-family resales.

Sales or Escrow Closings

Sales or escrow closings of single-family resales improved in May over April according to one number. Looking at the numbers, this may not be obvious because total sales of single-family resales in May were slightly less than April. There were 4,787 sales in May compared to 4,909 sales in April. So, May had 122 or two percent less sales than April. But the following is an explanation why May was a more productive month for sales than April.

For a sale or escrow closing to occur, an escrow company, on the day a property is to close, sends the deed to be recorded to the county recorder. Once the county recorder records the deed, the sale or escrow closing is consummated. So, both the escrow company and the county recorder must be open for a closing to occur. I will define a day in which both are open as a close of escrow day. There were twenty-two close of escrow days in April compared to twenty close of escrow days in May. So, April had two more days than May to close more transactions.

When dividing April escrow closings by the twenty-two close of escrow days, April averaged 223 closings per day. When dividing May escrow closings by the twenty close of escrow days, May averaged 239 closings per day. So, May had sixteen, or seven percent, more closings per close of escrow day than in April. Escrow companies have the capacity to close many more resale transactions then the number of closings that occurred this April and May. In April of 2019 there were 312 closings per close of escrow day. See Chart One.

How Single-Family Resales Were Purchased In May

When comparing how single-family resales were purchased in May to April, I found the following: Cash purchases were down nineteen percent. Conventional and jumbo purchases were down three percent. FHA purchases were up nine percent. VA purchases were up three percent. Thirty-five purchases with a VA loan had a purchase price over $500,000 and ten of these had a purchase price over $700,000.

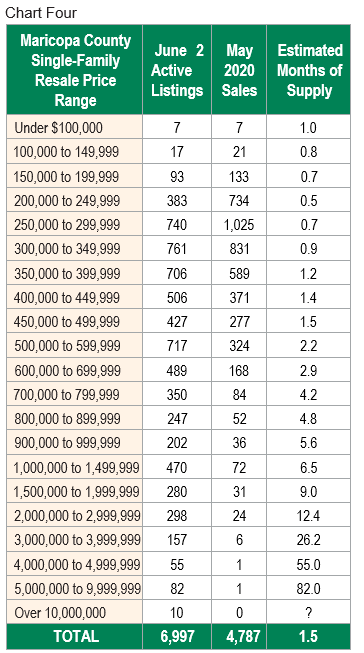

Daily Listings and Overall Inventory

The number of daily listings and overall inventory went down in May. Calendar days are used when calculating daily listings. May averaged 188 listings per day compared to 211 in April. So, new listings in May compared to April were down twenty-three or eleven percent per day. Since the

number of daily listings went down, down also is overall inventory. On May 1, there were 8,877 listings compared to 6,997 on June 2. This is a decline of 1,880 listings or twenty-one percent. See Chart Two.

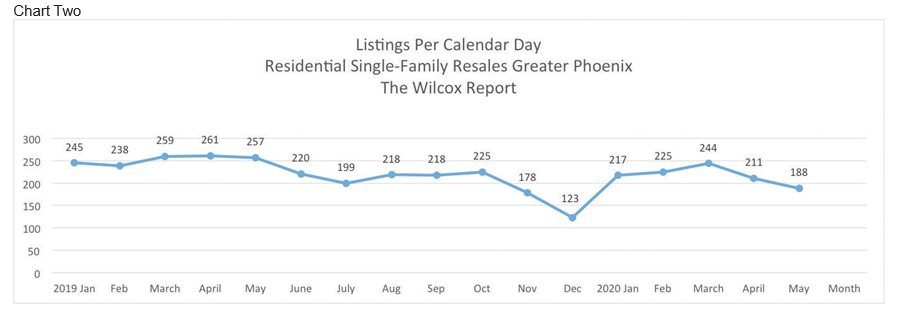

Median List Price and Median Purchase Price

In March, the median purchase price of $335,000 hit an all-time high. In April, the median purchase price stayed steady at $335,000. In May, the median purchase price dropped three percent from April to $325,000.

In February, the median list price hit an all-time high of $349,900. It dropped to $345,000 in March and dropped further in April to $339,990. But in May it was back up. The May median list price of $350,000 just beat out the previous record of $349,990 set in February. See Chart Three.

Estimated Months of Supply

With both sales and listing inventory down year-over-year the estimated months of supply has changed very little. There is less than a one month of supply of listings under $350,000. For listings from $350,000 to $500,000, there is less than a two month supply. See Chart Four.

Predictions

We probably hit bottom in April as to the lower number of escrow closings per day. Why? Escrow closings per day increased in May over April and should increase in June over May. In May, more properties went under contract than in April. This means more June closings. Overall sales in June should be higher than May, because June has one more close of escrow day than May. We saw a decrease in cash purchases from April to May. As travel picks up and we get more out-of-state visitors, cash purchases will increase. And as things stabilize, more investors paying cash should also increase. We almost certainly hit bottom in May as to the low number of daily new listings. June daily listings most likely will go up as the economy opens up and seller’s confidence goes up that the coronavirus storm is waning. In June, the median purchase price should be higher than May’s median purchase price. Why? Because inventory is still very, very tight in the most popular price ranges. An indicator that purchase prices may be higher in June is that the median list price increased in May. An area that may be challenged for more sales in June may be buyers that need to obtain a jumbo loan to purchase. This market tightened up, but may soon may loosen up as the economy picks up. Odds- on there will be more demand for homes with an office. Why? Because some workers will continue to work from home and not go back to the office. When running active single-family listings in ARMLS 3,214 out of the 6,997 listings had yes for the field separate den/office.

Incrementally the residential market should improve each and every month as the economy increases, the coronavirus decreases, the riots end. With all the people that want to live here, barring another unforeseen event, our market will roar once again.