Market Update: Single-Family Homes Become More Expensive to Buy and Rent Purchase Price and Monthly Rent Continue to Accelerate Extremely Strong Seller Market

October 6, 2020

Fletcher Wilcox

V.P. Business Development & Real Estate Analyst, Grand Canyon Title Agency

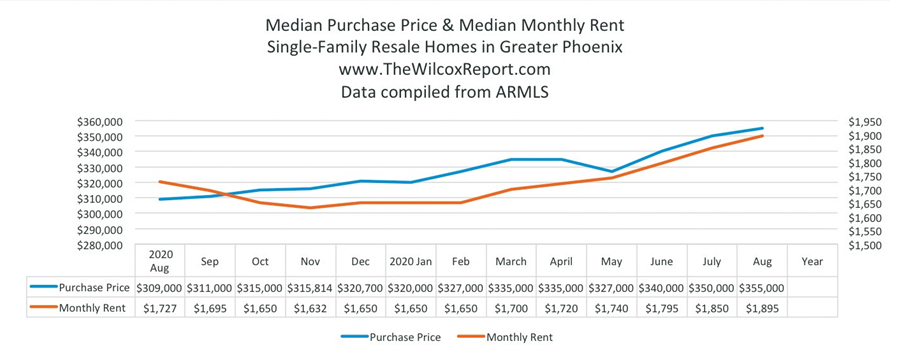

Purchase Price and Monthly Rent Accelerate

The demand to live in a single-family resale home is strong. So strong, the cost to live in one continues to surge. Median purchase price and median monthly rent reached record highs in August. Both are up double digits year-over-year. The August 2020 median purchase price for a single-family resale home was

$355,000, which is $46,000 or fifteen percent higher than August 2019. Earlier this year the median purchase price for a single-family resale home did take a dip. In May it was $327,000 down from $335,000 in April. Since May, the median purchase price has climbed $28,000 or nine percent. The August 2020 median monthly rent for a single-family resale home was $1,895, which is $168 or ten percent higher than August 2019. Median monthly rent did not dip in May as the median purchase price did, however, it did go down in October and November of last year. Since November 2019, median monthly rent is up $263 or sixteen percent.

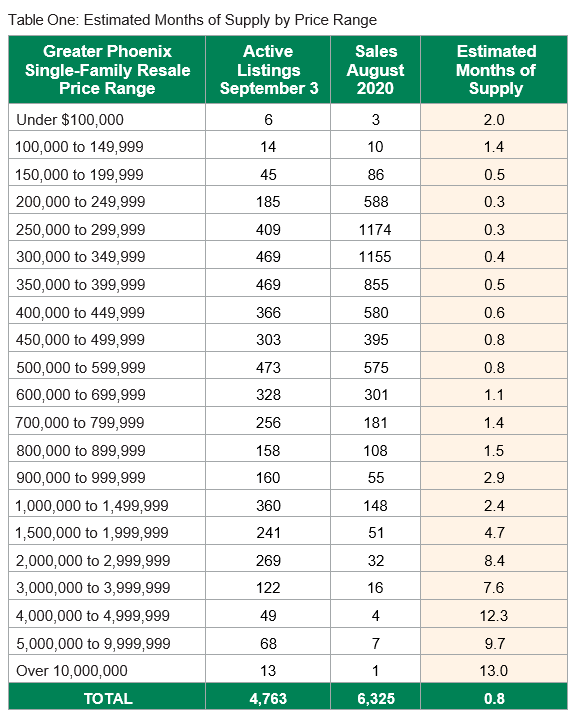

Purchase price is accelerating because of the abundance of demand and the drought of supply. On September 2, there were 4,700 active listings. Two months ago at this same time there were 7,000 active listings. Table One emphasizes the lack of supply. It shows the number of active listings and the estimated months of supply by price range. For listings between $200,000 and $300,000 there is about a ten-day supply. I think this is the lowest estimated months of supply that I have ever seen. For listings under $600,000 there is less than a one-month supply. In July and August of this year more sellers put their homes on the market than July and August of last year. This year-over-year increase in monthly listings will increase sales, but with demand so great it will do little, if anything, to change the estimated months of supply. The August 2020 median list price of a single-family resale home was $369,888. This too is a new record in this category.

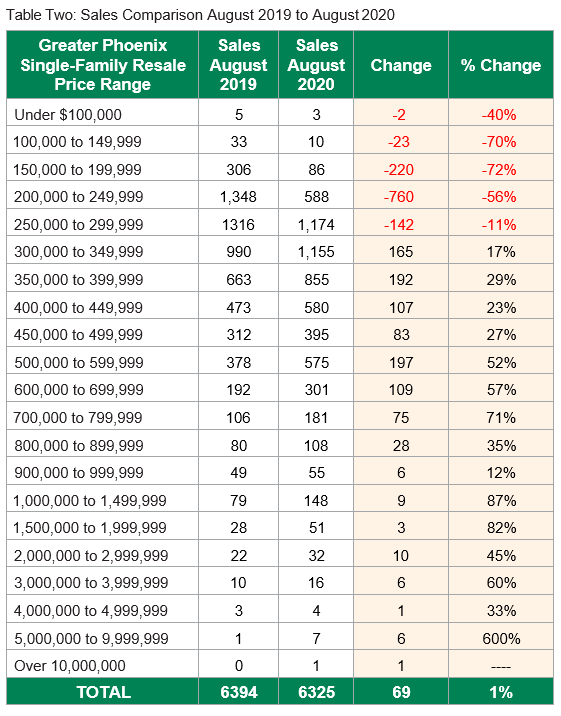

The number of sales in August 2020 were one percent or sixty-nine less than August 2019. There were 6,325 sales of single-family resale homes in August compared to 6,394 in August 2019. While the number of year-over-year sales was slightly lower, the dollar sales volume was much higher. Because of rising prices, August 2020 dollar sales volume of $2,854,028,294 was $438,309,290 dollars higher than in August 2019.

Table Two compares sales in August 2020 to August 2019 by price range. The table shows that there were more sales in every price range $300,000 and over this August. So at this point, hefty year-over-year gains in purchase price has not slowed the number of sales. This indicates that affordability has not become an issue. The obvious reason for this is low mortgage rates. If a buyer were to have purchased a home in August 2019 at the median purchase price of $309,000, put a down payment of ten percent and had a 3.77 percent thirty year fixed mortgage rate, which was the going rate at that time, their principal and interest payment would be $1,291.08. If that same buyer purchased in August 2020 at the median purchase price of $355,000, put down ten percent and got a 3.02 percent thirty-year fixed mortgage rate, the going rate, their principle and interest payment would be $1,350.47. So, a year later with a home price increase of $46,000 but with a lower mortgage rate the principal and interest increased only $59.39. Two other factors fueling sales are population growth and the Greater Phoenix job market.