Market Update: October Residential Numbers for Greater Phoenix

December 1, 2020

V.P. Business Development and

Real Estate Analyst Grand Canyon Title Agency

602.648.1230

fwilcox@gcta.com Founder TheWilcoxReport.com

Increase in Velocity of Homes Going Under Contract

The Rise and Now Decline of Days on Market

Home Values at Highest Year-Over-Year Increase in Seven Years

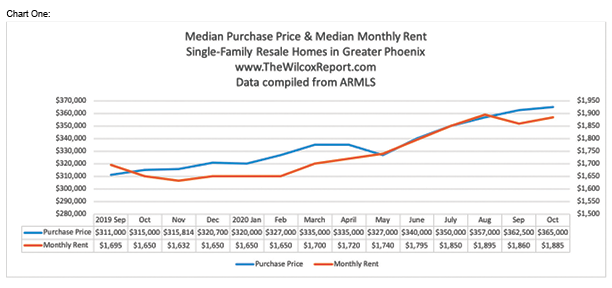

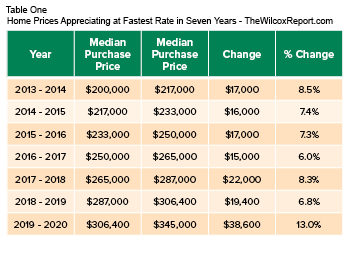

The median purchase price once again outperformed the previous month. For the fifth consecutive month, the median purchase price for a single-family resale home in Greater Phoenix reached an all-time high. See Chart One. It was $365,000 in October 2020. This is $2,500 higher than September 2020. This is the lowest month-over-month increase since May when the median purchase price took a one-month tumble. Year-over-year the October 2020 median purchase price is $50,000 or sixteen percent higher than October 2019, when it was $315,000. The median purchase price thus far in 2020 is thirteen percent higher than 2019. See Table One. This year-over-year increase is the highest in seven years. For the last six years the average year-over-year increase in the median purchase price is 7.4%.

The median monthly rent for a single-family resale home in Greater Phoenix continued its ascent in October 2020. It was $1,885. This is $25 higher than September 2020. October 2020 monthly rent year-over-year is $235 or fourteen percent higher than October 2019. The single-family rental market has boomed during the pandemic. Even before the pandemic, the robust demand to live in a single-family home saw single-family rental communities springing up in Greater Phoenix. So, if you can’t buy one, you rent one.

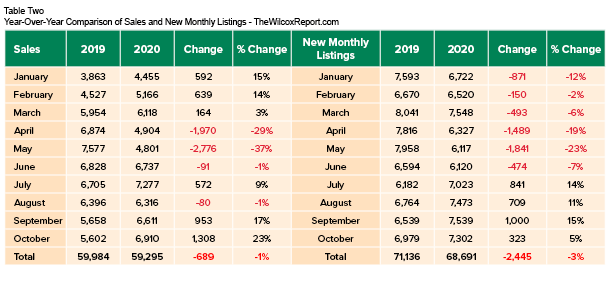

Sales of single-family resale homes have not slowed down. There were 6,910 sales in October 2020. This was 299 more than September 2020. Year-over- year October 2020 sales were 1,308 or twenty-three percent higher than October 2019. So far in 2020, this makes October 2020 the month with the highest year-over-year increase in sales. See Table Two.

New monthly listings of single-family resale homes in October 2020 were 7,302. This is the fourth consecutive month with over 7,000 new monthly listings. October 2020 listings were 323 or five percent higher than October 2019. Active listings of single-family resale homes on the Arizona Regional Multiple Listing Services, Inc., (ARMLS) for Greater Phoenix is at the lowest level I have ever seen. At the beginning of November there were 4,800. At the same time in October 4,700. Compare this to 8,800 at the beginning of May.

Just as our days are getting shorter, days on the market keep getting shorter. Agent days on the market, known as ADOM, were fifty days in July 2020 compared to thirty-eight days in October 2020. See Chart Two. The last time a month of October had a lower ADOM than October 2020 was fifteen years ago in October of 2005. So, the velocity of homes going under contract has greatly increased. Twenty-eight percent of homes in October 2020 were under contract in seven days or less compared to eighteen percent of homes in October 2019. There is a seventy-eight percent increase in homes going under contract in just one day in October 2020 compared to October 2019.

Looking at November

November 2020 will outperform November 2019 in the number of sales. However, when comparing November 2020 to October 2020 don’t be surprised that there will be less sales in November. The reason being that this November is a much shorter month than October. There are eighteen days this November to record a sale compared to the twenty-two days in October. In November, the median purchase price will be higher than October, which means this will be the sixth consecutive month it has increased. Expect inventory to continue to be very tight and may tighten a little more in November. With the increase velocity that homes are going under contract, if your buyer sees a home they want – and it is priced right – tell them not to blink – because if they do the home is gone.

The data in this report is compiled from the Arizona Regional Multiple Listing Services, Inc, known as ARMLS.