Tucson-Southern Arizona Market Report

March 1, 2021

Jim Daniel

RLBrownReports/Bright Future Real Estate Research

RLBrownTucson@gmail.com

602.327.6989

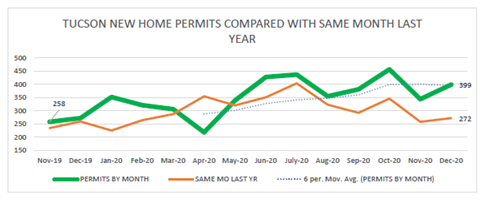

The numbers are in, and December was another solid month for Tucson housing, and 2020 ended with no complaints from the Tucson housing community. The big news for Tucson housing for December revolved around the 47% change for the good in December permit activity for the Tucson marketplace.

Year-to-date Tucson new home permits were up just over 17%, fulfilling the expectations of just about everyone involved in the housing market in Tucson, where we counted 4,336 new home permits for the year.

Barring some catastrophic event there is little reason not to anticipate a continuation of strong new housing activity over the next several months and potentially all of 2021 in Tucson.

New home closings were up 7.86% from last year, logging a total of 3,526 new homes closed in the Tucson market area. It’s important to note that a substantial part of the Tucson housing activity consists of custom homes, and many of those new homeowners already have title to the land so there is no close of escrow when the home is finished, resulting in an undercount of new home escrow closings versus permit activity.

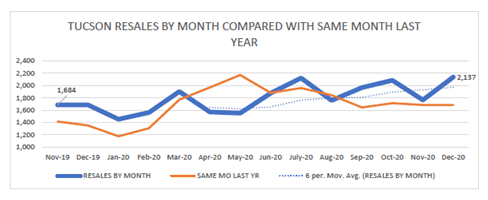

The resale market in Metro Tucson saw 4.6% year-over-year increase in activity but a nearly 27% increase in activity in December, which could bode well for the Tucson resale marketplace in the months ahead. Note that we have a complete analysis of the Tucson resale marketplace as a part of our Magic Pro data.

We start this month with our 13-month trend analysis of each of the Tucson housing market’s major components overlaid with a trendline to derive a perspective to the month-by-month performance numbers. Note that all of the data used in preparing these graphics are all from the sales and permit, land sales activity, and product data included in our Magic Professional Housing Data Application. It is developed from an analysis by our firm, each permit issued, and each recorded escrow closing.

Let’s take a look at the comparison of multiple months permit activity in the Tucson marketplace as compared with the same months in 2019. The green line shows permits by month in 2020 and what could be construed as a generally flat line from June through December. The blue dots show the six-month moving average trend of permit activity leveling off beginning in October in the range of 350 permits per month.

The track of closing activity follows a similar relatively flat trend in that same general 350 unit per month range. We need to remember that a large number of the custom homes do not see closings but do see permits because the land is already entitled to the custom homeowner.

The trend line for Tucson resale activity shows a gradual slope beginning in May 2020 and continuing through the year-end and suggests a continuation of that trend at least in the earlier part of 2021.

An analysis of new home average and median prices by month over 2020 shows a median price flattening. More and more affordable housing has been brought to market in the region. The continuing increase in the average new-home price has been due to the upward pressure on prices because of a combination of cost increases and improving builder confidence. The trendline for median prices suggests a flattening of those prices, which is likely to continue into 2021.

With over 3100 permits issued since April 2020 we expect new Home closings to remain strong through 2021 and permits should continue to be consistent, but we do not think they will top 2020 by another 17%.

Builders continue to add inventory lots and December saw 1079 lots closed. New home platting in December was strong and added 982 lots for future development. The Tucson housing market has many positive metrics, and the area should remain a desirable community to live and work in the future.

So, stay tuned for market updates as the year progresses here in our market letter and accurate and timely market data updated every month in Magic Pro.