Greater Phoenix Residential Market: 2021 April Results

June 1, 2021

V.P. Business Development and

Real Estate Analyst Grand Canyon Title Agency

Buyers Are Paying More — Getting Less

Median Purchase Price Reaches $420,000

Median Monthly Rent Almost $2,000

Results for Twenty-Six Cities

The information in this report was compiled from Arizona Regional Multiple Listings Services, Inc., data. The following results are for single-family resale homes in Greater Phoenix. Single-family resale homes are the most popular residential category in terms of the number of monthly sales.

The median purchase price continues to increase in leaps and bounds. April’s median purchase price of $420,000 was the eleventh straight month of an increase and a new record. April’s median purchase price was $13,750 or 3.3 % higher than March 2021. Look at the growth of April’s median purchase price compared to the month of April for the previous three years. In April 2020 it was $335,000, in April 2019 $297,500 and in April 2018 $285,000.

The median monthly rent also continues to go up by bounds and leaps. In April it was $1,995. Yes, this is a new high. April’s median monthly rent was $45 or 2.3% higher than in March 2021. Median monthly rent in April 2020 was $1,720, in April 2019 $1,645, and in April 2018 $1,545.

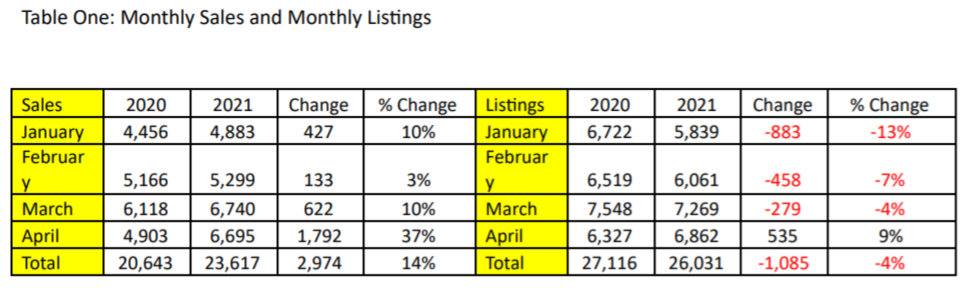

The number of monthly listings and monthly sales crashed in April 2020due to the coronavirus effect. So, it is no surprise that both listings and sales were higher this April than last April. But the percentage change year-over-year was much higher for sales than listings. In April 2021 there were 6,695 sales which is 1,792 or 37% higher than April 2020 sales. April 2021 listings were 6,862 or 9% higher than April 2020.

Agent days on market or ADOM in April 2021 were 27 days compared to 47 days in April 2020. The average sale had the buyer paying 102% of list price in April 2021 compare to 99% in April 2020.

Buyers Are Paying More And Getting Less. Because of an abundant supply of buyers and a scarce supply of listings along with the speed that homes are selling, buyers are paying more for single-family resale homes today than ever before. This imbalance has created an extreme seller’s market. So much so that some sellers are not making repairs or upgrades that they would have made in previous years in order to sell their home. I have heard of homes that need thousands of dollars in repairs / upgrades that some sellers are not willing to do. And the homes still sell. I was told of a new construction home in Paradise Valley that sold for $2,500,000. The listing agent said potential buyers complained that the fixtures were not quality. It didn’t matter because the home didn’t last long on the market. So, buyer you want better fixtures? Then buy the home and put them in.

Table Three has April 2021 single-family resale home results for twenty-six cities located in either Maricopa or Pinal Counties. It compares year-over-year, sales, new listings, and median purchase price and median monthly rents. The higher priced and luxury markets are on fire. Interestingly, the cities with highest median purchase prices had the largest percentage increases in year-over-year sales. Year-over-year sales in Paradise Valley were up 169%, Scottsdale 93% and Fountain Hills 80%.

May Predictions. The median purchase price in May will be higher than April’s $420,000. Maybe ending at $430,000 – $435,000 in May. Many listings will continue to sale over list price. The median monthly rent in May 2021 will be over $2,000. Maybe close to $2,100. There will be more active listings hitting the market this May than last May. And as competitive as it is to get a contract accepted, I always remind every buyer and every buyer’s agent to never give up! So far this year, there are almost 3,000 more sales than last year. So be prepared for action!

Note: Starting soon will be a monthly call for real estate agents to go over trends and strategies for competing in today’s residential marketplace. To receive notification, email me at FWilcox@gcta.com

The information in this report is deemed accurate but real estate agents, buyers and sellers should verify any information contained in this report before buying or selling.