Greater Phoenix Residential Market

December 1, 2021

Fletcher Wilcox

V.P. Business Development and

Real Estate Analyst

Grand Canyon Title Agency

fwilcox@gcta.com

Founder TheWilcoxReport.com

Purchase Price Reaches New High

Monthly Rents Slightly Decrease

2022 Forecast for 30 Year Fixed Mortgage Rate

In this report we compare median purchase price, median monthly rent, sales, and listings for single-family resale homes in Greater Phoenix. The information in this report was compiled from Arizona Regional Multiple Listings Services, Inc. (ARMLS) data. ARMLS showed 7,239 sales in October 2021 in Greater Phoenix for their eight residential categories. Out of those 7,239 sales, 5,836 or 81% were in the residential category single-family detached home. The majority in this category are single-family resales. Because sales of single-family resale homes dominant the market, they are the focus of this report.

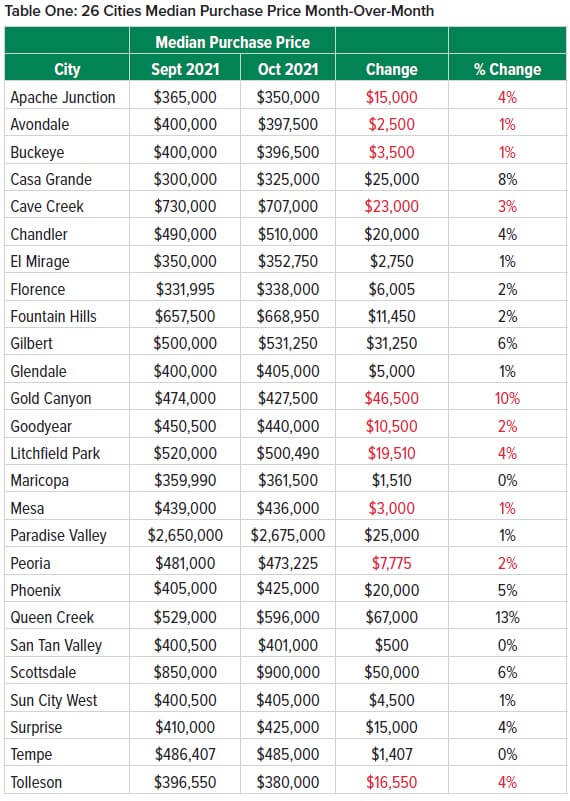

The strong demand to live in a single-family resale home continues to march on. The overall median purchase price for a single-family resale home in Greater Phoenix jumped up in October reaching a new high. This is after staying flat for three consecutive months at $450,000. October’s median purchase price was $460,000. This is $10,000 or 2.2% higher than September 2021. See Chart One. When comparing the median purchase price from September 2021 to October 2021 for 26 cities in either Maricopa or Pinal Counties, Table One shows that sixteen cities had price increases and ten cities had price decreases. When comparing year-over-year, October’s overall median purchase price is $95,000 or 26% higher than October 2020. Of course, the median purchase price is up year-over-year in all 26 cities. See Table Two. What is not up for all 26 cities year-over-year are sales and listings. Sales for this October compared to last October sales are down in nineteen cities and listings are down in twenty-two cities. It should be no surprise that both sales and listings were down in most cities this October compared to last October. Last year at the end of winter and into spring, Covid-19 kept many sellers and buyers out of the market, only to have them flood the market the remainder of the year. In October 2020, the overall number of sales for single-family resale homes was the highest ever for a month of October in Greater Phoenix. The number of listings in October 2020 was the highest in seven years for a month of October. The overall median monthly rent for a single-family resale home in Greater Phoenix in October 2021 was $2,295. This is $5 less than the $2,300 record high in September 2021. The overall estimated months of supply for single-family resale homes in Greater Phoenix is very low. For listings under $500,000 it is ten to twenty-four days depending on price point. For listings $500,000 to $799,999 about a one-month supply. From $800,000 to $1,500,000 a one to two-month supply.

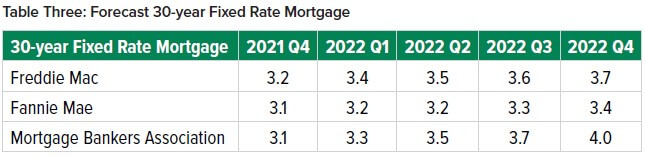

Forecast: 30-year Fixed Rate Mortgage

Table Three shows what Freddie Mac, Fannie Mae and the Mortgage Bankers Association forecast the 30-year fixed rate mortgage to be for all four quarters in 2022. All three organizations predict higher mortgage rates next year with mortgage rates going higher as the year goes on. Freddie Mac expects total national home sales in 2021 to be 6.8 million and in 2022 expects 6.8 million sales, while Fannie Mae projects total national home sales in 2021 to be 6.77 million and 6.54 million in 2022. The consensus is home prices will rise in 2022, but at a slower pace than 2021. There is not a consensus on whether inflation will persist or alleviate in 2022. It depends on if the cause is monetary policy or if supply chain shortages or a combination of both.