Greater Phoenix Residential Market

March 1, 2022

Fletcher Wilcox

Russ Lyon Sotheby’s International Real Estate

fletchw@cox.net

Founder TheWilcoxReport.com

Arizona Gains Back All Jobs Lost in 2021 and Then Some!

Results for January 2022

What Buyers Should Expect

Will the Median Purchase Price for a Single-Family Resale Reach

$500,000 in 2022?

Arizona Gains Back All Jobs Lost in 2021 and Then Some!

Arizona is one of the few states that has not only gained back all lost jobs during the Covid-19 crisis but now has more jobs than pre-Covid-19. In February 2020 3,007,600 people were employed in Arizona according to the Arizona Commerce Authority. By the end of April 2020, the number of people employed was 2,679,900. A loss of 327,700 jobs in two months. Fast forward to December 2021. The number employed 3,054,800. Not only has Arizona gained back the 327,700 lost jobs but gained an additional 47,200 more jobs than pre-covid-19. Propelling the AZ job recovery were population growth and Arizona’s more relaxed Covid-19 restrictions. In March 2020, Arizona Governor Doug Ducey issued a list of essential services which were to remain open during Covid-19. Included on that list was real estate services. During the Covid-19 crisis people moved to Arizona for job opportunities and companies moved to Arizona for labor opportunities. According to the U.S. Census Bureau in both 2020 and 2021 Arizona had the third largest year-over-year numeric population increase amongst all states. Only Texas and Florida gained more people those two years. With Arizona being open for business, and with job growth and with population growth, the second half of 2020 spurred the greatest number of sales for single-family resale homes ever for a second half of a year in Greater Phoenix. The demand to own continued into 2021. Rising purchase prices made 2021 the record year for residential dollar sales volume in Greater Phoenix.

January 2022 Results for Greater Phoenix Sales of Single-Family Resales

January 2022 year-over-year (YOY) sales and listings for single-family resales were down. January 2022 sales were 4,563 which was 320 or 7% less than January 2021. January 2022 listings were 5,418 which was 421 or 7% less than January 2021. What was not down was the median purchase price for a single-family resale home. January 2022 median purchase price, yes, once again reached a new high. It was $485,000. This is $105,000 or 28% higher than January 2021. January 2022 median purchase price was $10,000 or 3% higher than December 2021. January 2022 median monthly rent of $2,280 was up YOY. It was $385 or 20% higher than January 2021. Table One has YOY median purchase price and YOY median monthly rent for twenty-six cities.

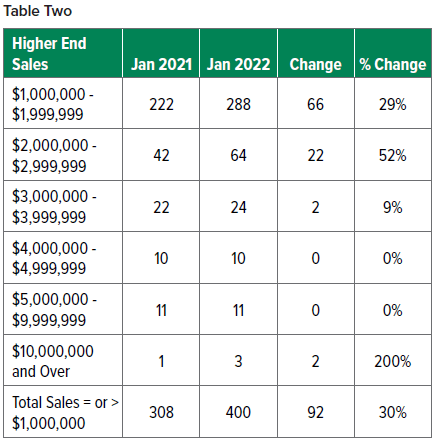

As Home Values Increased Sales at or Over $1,000,000 Increased

There has never been a month of January that had more sales at or over $1,000,000 than January 2022. There were 400. January 2021 did have the previous record at 308 sales. For sales between $2,000,000 and $2,999,999 there were 64. Last year 42. This makes January 2022 the best January on record in this category. See Table Two for the January 2022 number of higher end sales by price range.

What Buyers Should Expect the Next Few Months

Competition amongst buyers to purchase homes will remain extremely high. Why? The number of existing homes for sale on the market at any one time is at an all-time low. At an all-time high is the number of potential buyers. Swelling the number of potential buyers is population and job growth. I expect a continuous migration of buyers moving into Arizona in 2022. Go to an open house. You may be amazed at the number of visitors from out-of-state. (Prediction: in December 2022 when the U.S. Census Bureau releases state population data, AZ for the third consecutive year will finish third in numeric population increase). Arizona job growth should continue into 2022. With AZ now having more people employed than ever before means more potential buyers than ever before. Which means buyers must be more prepared than ever before.

Part of this preparation includes discussions with your agent on contract writing. Some buyers to make their offer more competitive will waive the inspection period and/or make the earnest money non-refundable. A buyer needs to understand the potential consequences of doing so. Some buyers may waive the appraisal contingency pursuant to the financing section of the contract. If a buyer does this, they agree that if the property fails to appraise for the purchase price that the buyer agrees their down payment will be increased by the difference between the appraised value and the purchase price. Agreeing to this requires a serious conversation with their loan officer. Some buyers may submit an offer using an appraisal shortfall clause. This clause sets a maximum dollar amount that the buyer will increase either their funds or financing if the premises does not appraise for the purchase price. If a buyer is purchasing with cash, they may want to consider using an all-cash sale appraisal contingency clause. Whatever the case, if a buyer finds a home they want, they may not want to wait too long before submitting an offer. Some homes are gone in the blink of an eye.

Finally, I expect the Greater Phoenix median purchase price to continue to rise in 2022. Though, at a slower pace than last year. It may be flat or go down some months but will rise in other months. Will the Greater Phoenix median purchase price for a single-family resale home reach $500,000 in 2022? Yes.

The information on sales, listings, median purchase price and median monthly rent were compiled from data provided from the Arizona Regional Multiple Listing Services, Inc. The information contained in this article is for general information purposes only. And should not be construed as legal or financial advice. Readers are urged to consult with a real estate professional, a financial advisor, and an attorney.