Greater Phoenix Residential Market

April 1, 2022

Fletcher Wilcox

Russ Lyon Sotheby’s International Real Estate

fletchw@cox.net

Founder TheWilcoxReport.com

Arizona Gains Back All Jobs Lost in 2021 and Then Some!

Results for January 2022

What Buyers Should Expect

Will the Median Purchase Price for a Single-Family Resale Reach

$500,000 in 2022?

February 2022 Results for Sales of Single-Family Resale Homes

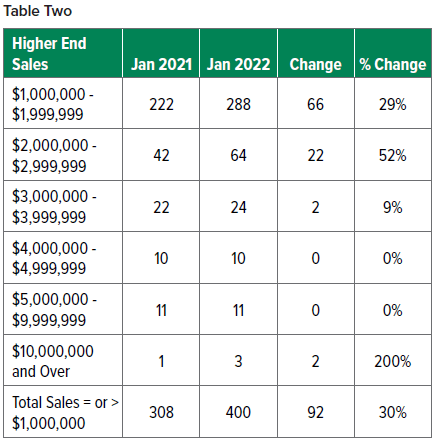

The February median purchase price (MPP) for a single-family resale home in Greater Phoenix reached $500,000. I expected we would soon see $500,000. Just not this soon. At the conclusion of this article see what I predict the MPP will be for March. February 2022 MPP was $15,000 or 3% higher than January 2022. Year-Over-Year (YOY) February’s MPP was $105,000 or 27% higher. Sales of single-family resale homes in February 2022 of 5,282 were 744 or 16% higher than January. February YOY sales were just 17 shy of February 2021. Days on market declined. They were 32 in February 2022 and 35 in January 2022. Days on market in February 2021 were 38. February 2022 listings of 5,611 were 210 or 4% less than January 2022. It is not unusual for February to have less listings than January, since February is a shorter month. YOY February 2022 listings were, however, 449 or 7% less than February 2021. February 2022 median monthly rent was $2,200. This is $82 or 4% less than January 2022. YOY February 2022 median monthly rent was $305 or 16% higher than February 2021.

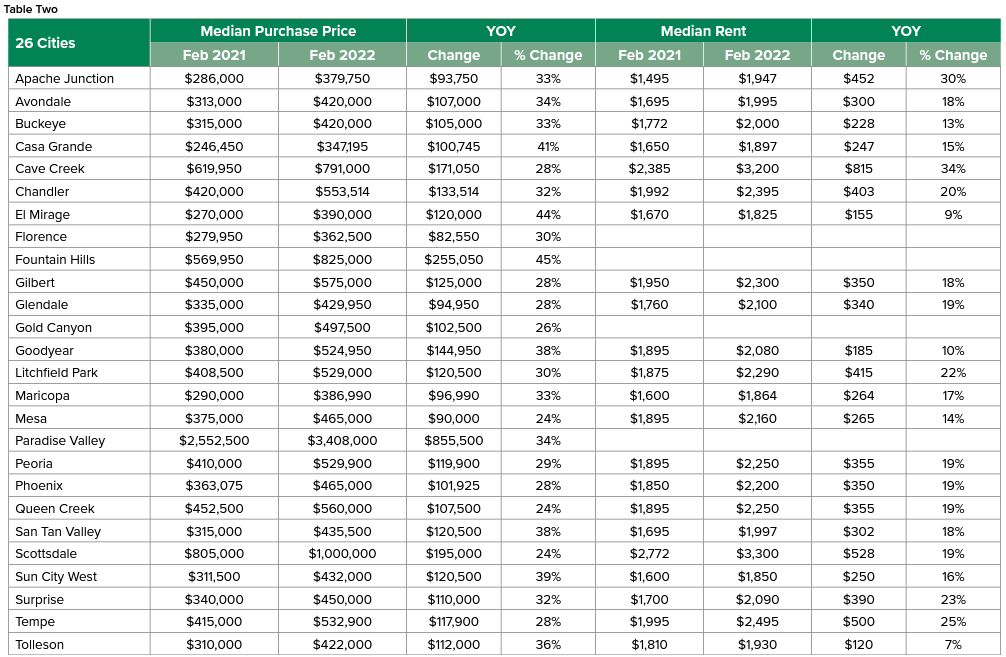

The Scottsdale median purchase price for a single-family resale home in February 2022 was $1,000,000 for the first time. In February 2021 it was $805,000 and in February 2020 $685,000. The Paradise Valley median purchase price for a single-family resale in February 2022 was $3,408,000. In February 2021 it was $2,552,500 and in February 2020 $1,730,000.

January 2022 Results for Greater Phoenix Sales of Single-Family Resales

January 2022 year-over-year (YOY) sales and listings for single-family resales were down. January 2022 sales were 4,563 which was 320 or 7% less than January 2021. January 2022 listings were 5,418 which was 421 or 7% less than January 2021. What was not down was the median purchase price for a single-family resale home. January 2022 median purchase price, yes, once again reached a new high. It was $485,000. This is $105,000 or 28% higher than January 2021. January 2022 median purchase price was $10,000 or 3% higher than December 2021. January 2022 median monthly rent of $2,280 was up YOY. It was $385 or 20% higher than January 2021. Table One has YOY median purchase price and YOY median monthly rent for twenty-six cities.

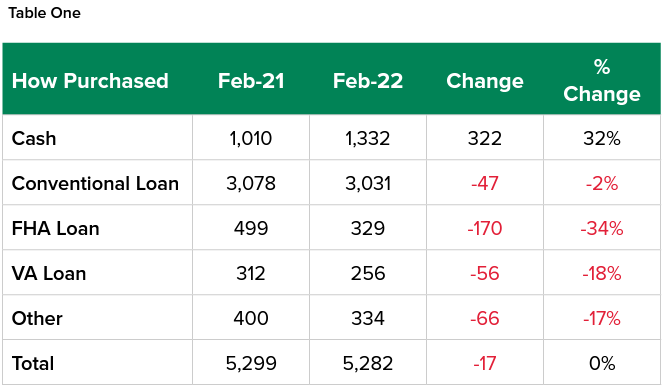

How Homes Are Being Purchased

While cash is not the primary way single-family resale homes are being purchased, it is the second most popular way to purchase. Overall, in February 2022, 25% of purchases were with cash, 57% conventional loan, 6% FHA, 5% VA and 6% other. YOY homes purchased with cash increased. In February 2022, 1,332 were purchased with cash compared to 1,010 in February 2021. This is a YOY increase of 32%. YOY purchases with a conventional loan were down 2%. YOY purchases with a VA loan down 18% and with an FHA loan down 34%. See Table One. The maximum loan limit in Maricopa County for FHA is $441,600. The ceiling for a conventional conforming loan is $647,200.

Twenty-Six City Purchase Price & Monthly Rent

Table Two shows the YOY median purchase price and the YOY median monthly rent for twenty-six cities.

Desktop Appraisals

I interviewed Robert Oglesby President/Owner of AppraisalTek on desktop appraisals. (Last year Robert spoke at the Arizona School of Real Estate’s Luxury Home Seminar giving us tips on appraising the uniqueness of a luxury home. We hope to have him back. The 2022 Luxury Home Seminar will be on April 29. Don’t miss it). Back to desktop appraisals. I learned the following from Robert: He said to expect both Freddie Mac and Fannie Mae to start using desktop appraisals in March 2022 for purchases of owner-occupied homes with an LTV less than or equal to 90%. That the appraisal industry moved in this direction to be more in step with the digital times.

While desktop appraisals have been around, there are changes to the workflow. The desktop appraisal must include photos and a digital floorplan of the interior layout, walls and exterior measurements supporting an accurate gross living area. The appraiser may obtain pictures, floorplan, and property detail from the following sources: Third-party sources, multiple listing service, public sources, online sources, appraisers, appraiser trainees, real estate agents, and homeowners.

The increased use of desktop appraisals he said will create challenges, but over time the appraisal process will improve. The use of desktop appraisals he said will help avoid appraisal bias.

References:

https://singlefamily.fanniemae.com/media/30361/display

https://guide.freddiemac.com/app/guide/bulletin/2022-2

Market Update Conclusion

For most areas in Greater Phoenix, residential inventory is extremely tight, days on market continue to decrease, while cash buyers increase. Add these to population growth and job growth and inflation and the cost to purchase a residential home by the end of the year should be fairly higher than it is today. Of course, that is, barring a black swan event, which is an event that is beyond what is normally expected and has the potential to negatively affect the market.

Prediction for what the MPP for a single-family resale home in Greater Phoenix will be in March 2022: $515,000. March 5 is the date I made this prediction.

The information in this report was compiled from the Arizona Regional Multiple Listings Services, Inc.

The information on sales, listings, median purchase price and median monthly rent were compiled from data provided from the Arizona Regional Multiple Listing Services, Inc. The information contained in this article is for general information purposes only. And should not be construed as legal or financial advice. Readers are urged to consult with a real estate professional, a financial advisor, and an attorney.