Greater Phoenix Residential Market

January 3, 2023

What is a Mortgage Buydown?

Negotiate Maximum Seller Concessions by Loan Type

The Market Shift Continues

Fletcher R. Wilcox

Russ Lyon Sotheby’s International Realty

602.648.1230 Fletcher.Wilcox@RussLyon.com

The Mortgage Buy-Down

The market has shifted from rising purchase prices and a high number of sales to decreasing purchase prices and decreasing sales. High mortgage rates are what is driving this market shift. Prior to 2022, the thirty-year fixed mortgage rate in both 2021 and 2020 was the lowest in fifty years. It averaged 2.96% in 2021 and 3.11% in 2020. These low rates fueled the boom in sales and the rise in purchase prices. Today, the thirty-year fixed mortgage rate is more than double what it was last year. It averaged 6.90% in October 2022. If you have been selling real estate for less than fourteen years, you have not worked in a market where the thirty-year fixed mortgage rate averaged six percent or more. The last time it averaged six percent or more was in 2008.

With sales decreasing, competition amongst sellers is increasing. This competition has tripled the number of transactions that have recently closed with a seller concession. According to ARMLS data, 48% of sales in November 2022 had a seller concession compared to 15% in November 2021. A seller concession is when the seller credits a portion of their proceeds to the buyer. The buyer then uses the credit to pay their closing costs. This shift in transactions closing with a seller concession is bringing back something that has not been vogue. Back is the mortgage buy-down.

What is a Mortgage Buy-Down? A mortgage buy-down is when the seller, builder or buyer pay mortgage point(s) sometimes called discount point(s). Paying for mortgage point(s) allows a buyer to buy down or to obtain a lower monthly mortgage rate.

What is the difference between a temporary and permanent mortgage buydown? For a temporary mortgage buydown, you might see the terminology 3-2-1 buydown. This means that the buyer will pay a lower mortgage rate the first three years of the loan. For example, if a buyer qualified for a $450,000 mortgage at 6.5% for thirty-years, the first year of the buy-down their rate would be 3.5% (3% less than the 6.5%). Year two, the mortgage rate is 4.5% and year three 5.5%. Starting in year four the rate is 6.5% for the life of the loan. So, for the first three years the buyer saves $20,112 in principal and interest payments in this scenario. However, the buyer must be able to qualify at the 6.5% mortgage rate and the mortgage buydown will cost.

Example of a 3-2-1 Buy-Down for a $450,000 loan at a 6.5% Mortgage Rate

A permanent mortgage buy-down is when the mortgage rate is bought down for the life of a loan. The lower the mortgage rate and the more years that a mortgage rate is bought down the more it will cost.

What benefits a buyer more? A $10,000 purchase price reduction or a $10,000 seller contribution? Generally, buying down the mortgage rate will lower a buyer’s monthly principal and interest payment more than lowering the purchase price by the same amount as the cost of the mortgage buy-down. A buyer should meet with their lender to determine which is better for the buyer.

Should a Seller Advertise in Their Listing That They are Offering a Seller Concession? The seller and their real estate agent should discuss the pros and cons of doing this.

Negotiate the Maximum Seller Concession

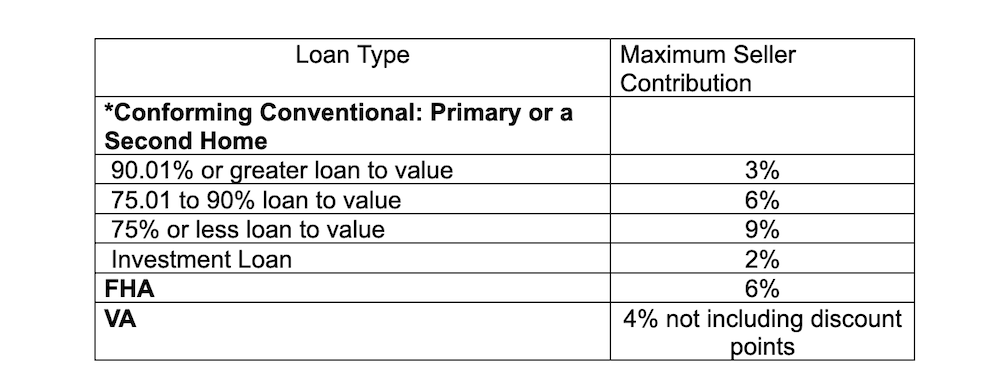

Knowledge of the maximum seller concession by loan type will allow a buyer to better negotiate a mortgage buydown with a seller. The table below shows what the maximum contribution a seller may make by loan type. The maximum seller concession amount is determined by the lower of the purchase price or the appraised value.

*Starting in 2023 the new conforming conventional loan amount will be $726,200

*Starting in 2023 the new conforming conventional loan amount will be $726,200

While this article is focused on using a seller concession to buy down a mortgage rate, the buyer may use a seller concession to pay partial or all of a buyer’s closing costs. The AAR Residential Resale Real Estate Purchase Contract reads on lines 100-102, “Seller Concessions (if any): In addition to the other costs Seller has agreed to pay herein, Seller will credit Buyer _____% of the Purchase Price OR $_____ (Seller Concession). The Seller Concessions may be used for any Buyer fee, cost, charge, or expenditure to the extent allowed by Buyer’s lender.”

November 2022 Single-Family Resale Results for Greater Phoenix

Unless otherwise mentioned, the following results are for single-family resale homes in Greater Phoenix. The information used in this report was compiled from data provided by the Arizona Regional Multiple Listing Services, Inc.

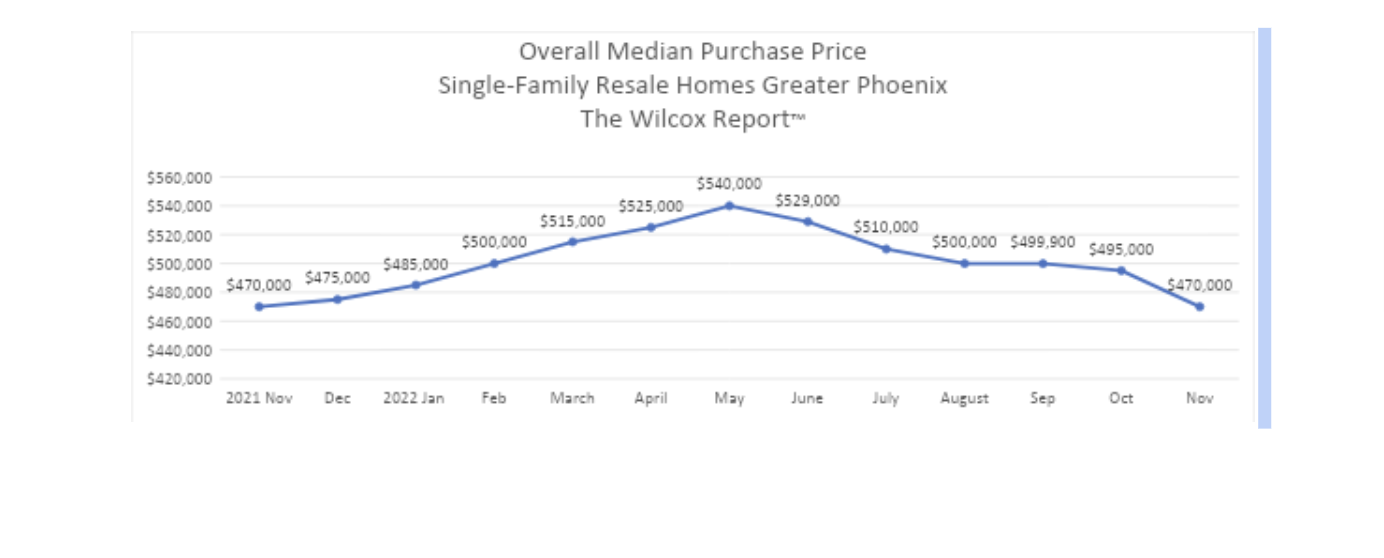

Overall median purchase price (MPP) for a single-family resale home in Greater Phoenix dropped in November from October. It was $470,000 in November, down $25,000 or 5% from October. November’s MPP was the same as the previous November. See Chart One. Overall sales in November 2022 were 3,178. October to November overall sales were down by 294 sales or 8%. November 2021 compared to November 2022 overall sales were down by 2,676 or 46%. Overall new monthly listings in November 2022 were 3,914. October to November overall new monthly listings were down 1,277 or 25%. November 2021 compared to November 2022 overall new monthly listings were down 1,717 or 30%.

Overall median monthly rent (MMR) for a single-family resale home dropped for the second consecutive month. It was $2,200 in November 2022. This is lower by $50 or 2% than October. MMR in November 2022 was lower $70 or 3% than November 2021.

While the previous paragraphs reviewed overall results for Greater Phoenix, the following paragraph reviews results for thirty-three cities located in either Pinal or Maricopa Counties. How did your city do?

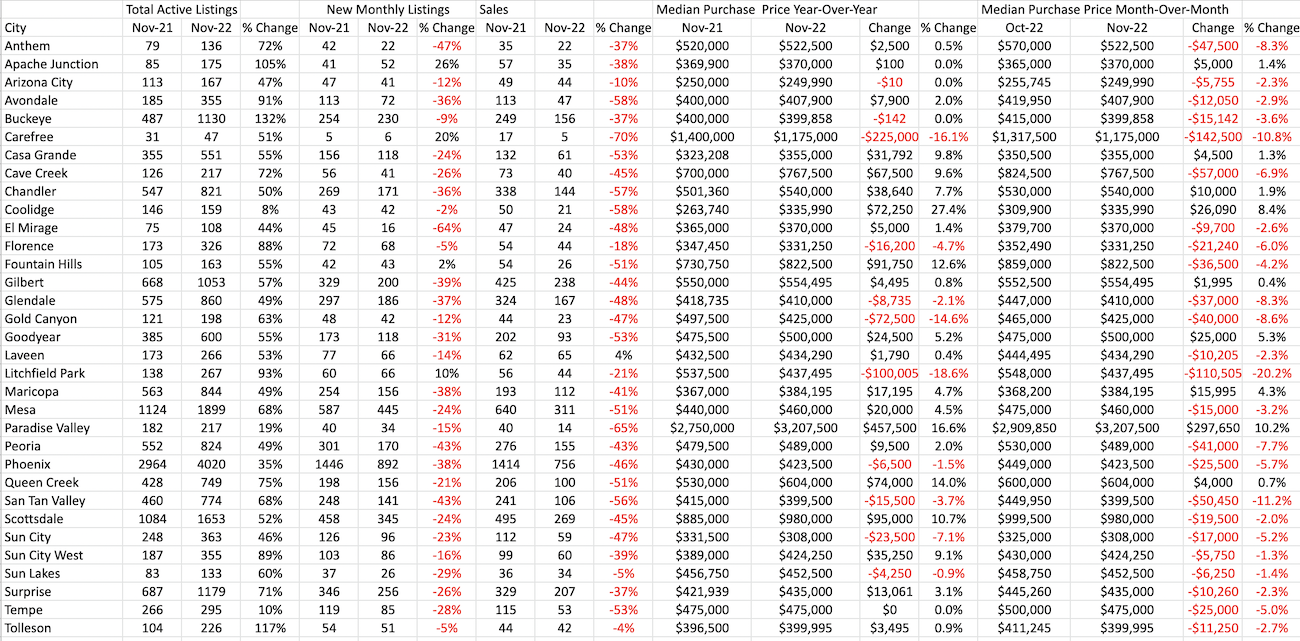

Table One compares the MPP for thirty-three cities in either Pinal or Maricopa Counties month-over-month (MoM) and year-over-year (YoY). Table One also compares YoY for each city total active listings, new monthly listings, and sales. Starting with sales, 32 of the 33 cities had less sales in November 2022 than November 2021. Next is total active listings. All thirty-three cities had a YoY increase in total active listings. Twenty-three of the cities have 50% or more total active listings than they did last year. The next category, new monthly listings, compares how many listings came on the market in the month November 2022 compared to the previous November. While inventory had been piling up, now, less sellers are listing their homes for sell. Twenty-three of the cities had less new monthly listings this November than last November. When it comes to the MPP MoM nine cities had increased in their MPP, while twenty-four cities had decreased in their MPP.

Chart One: Overall Median Purchase Price

Table One: November Results for Thirty-Three Cities in AZ by The Wilcox Report™