2018 National & Local Home Market

November 1, 2017

Nadia Evangelou

Research Economist, NATIONAL ASSOCIATION OF REALTORS®

While we are inching closer to the end of the year, it is time we take a moment to conduct a housing market recap and forecast for 2018.

Closing activity for existing home sales at the national level has been choppy, but so far generally higher than a year ago. On a month-to-month basis, existing home sales in August dropped for the fourth time in five months, while contract activity fell for the fifth time in six months. In the meantime, Hurricane Harvey devastated the Houston area, while preparations in Florida for Hurricane Irma began in August. Due to the impact of both hurricanes, home sales activity in the South region declined in August and will likely continue to do so in the months ahead. Taking into consideration the decline in momentum, we expect that home sales activity in 2017 will be 0.2 percent lower than the activity in 2016. However, existing home sales are expected to rise 6.9 percent in 2018.

Whereas home sales will not make gains, home prices will. While inventories are at low levels, Hurricane Harvey and Hurricane Irma will also have a negative impact on housing starts in the upcoming months as more workers help rebuild rather than participate in new construction. Thus, the national median price will likely rise by 5.7 and 4.6 in 2017 and 2018, respectively.

However, all real estate is local, so this national picture of the housing market may not apply to every area across the Unites States. For instance, housing activity in the Arizona area is expected to be better in 2017 than activity in 2016, as the employment growth average has been tracking above the national average. Based on our analysis, a middle-income family in Arizona would have access to nearly 50 percent of the live inventory. That is quite good, considering that in the adjacent state of California only 15 percent of the live inventory is affordable for a middle-income family. Since job growth in Arizona is strong, more people can expect to be able to afford to buy a home.

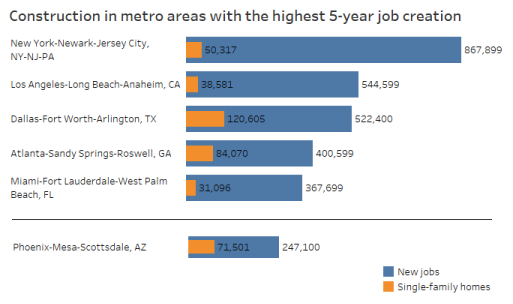

A deep look into the Phoenix housing market reveals that the area offers many opportunities to people who seek to relocate and companies that look to expand. Cumulatively over the past five years, job gains in Phoenix have been some of the best. Specifically, the Phoenix-Mesa-Scottsdale market added 247,100 new jobs. But how many new single-family homes were constructed to accommodate all these new workers? Phoenix-Mesa-Scottsdale built 71,501 single-family homes. In comparison, the San Francisco-Oakland-Howard market created 343,000 jobs, while only 20,241 homes were added in the market. Consecutively, the ratio of new jobs to new single-family homes was 3:1 in Phoenix-Mesa-Scottsdale, compared to 17:1 in San Francisco-Oakland-Howard. This means that in Phoenix-Mesa-Scottsdale a new single-family home is built for every 3 new jobs, while in San Francisco-Oakland-Howard a single-family home is added for every 17 new jobs. This example shows the home building divergence among metro areas with strong employment growth. For further comparison, the table below shows the number of new single-family homes added in the top ten metro areas with the highest five-year job creation:

Historically, one new housing unit is required for every two jobs. Therefore, demand is outpacing supply and the home price outlook is solid in Phoenix-Mesa-Scottsdale. Compared to other metro areas, Phoenix-Mesa-Scottsdale is more affordable since the construction rate is higher than other metro areas like San Francisco-Oakland-Howard. Nevertheless, more homes are needed in Arizona.

Furthermore, Arizona experienced migration gains in 2015. While less than half of states have more in-migrants than out-migrants, Arizona had 17,142 more people moving in compared to those who moved out from the area. Most of them came from California and Texas. According to the American Community Survey, the median age of those who moved in Arizona in 2015 was 36.

Overall, it seems that the following year will be busy for REALTORS® in Arizona. If construction activity keeps up with the strong job growth, expect more people to move to Arizona from other areas where affordability is low. Home sales in the state could once again outpace the national growth rate.

Nadia is a Research Economist at the National Association of REALTORS®. She focuses on regional and local market trends including the effects of changing demographic and migration patterns. Nadia also studies the effects of tax policies on the real estate market. She holds a master’s degree in Applied Economics from Johns Hopkins University, as well as advanced degrees in International European Economics and Public Administration.