Twelve Metrics that Snapshot the Residential Market

March 2, 2023

Why the 2023 Residential Market is not the same as the 2008 / 2009 Market

By Fletcher R. Wilcox

Russ Lyon Sotheby’s International Realty

602.648.1230

Fletcher.Wilcox@RussLyon.com

Unless otherwise mentioned, the following results are for single-family resale homes in Greater Phoenix, by far the most popular product when measured by the number of sales. The information sources used in this report are compiled from the Arizona Regional Multiple Listing Services, Inc., The Cromford Report, Freddie Mac and the Arizona Commerce Authority.

Twelve Metrics that Snapshot the Residential Market

- The number of weekly accepted contracts for the week of January 22, 2023 was 1,367. This is 12% (187) lower than one year ago during the same time frame. The number of weekly accepted contracts the week of January 22, 2023 were 148% (815) higher than in December 2022.

- In January 2023, the number of sales or closings was 2,787. This is 39% (1,751) less than last year during the same time frame (4,538). January 2023 sales were 16% (544) less than December 2022 (3,331).

- In January 2023, the thirty-year fixed mortgage rate averaged 6.3%. Last year, it averaged 3.4% in January.

- Average cumulative days on market in January 2023 were 78. This is an increase of 43 days or 123% compared to January 2022 (35 days).

- Total active listings on January 31, 2023 were 9,563. This is 209% (6,471) more listings than January 31, 2022 (3,092). (Remember these listing numbers are for single-family resale homes in Greater Phoenix).

- January 2023, new monthly listings were 4,725. This is 19% (1,095) less than January 2022 (5,820)

- Estimated months of supply excluding under contract with backups on January 28, 2023 was 3.3 months. It was .6 months on January 29, 2022.

- The overall median purchase price in January 2023 was $460,000. This was $25,000 or 5% lower than January 2022 ($485,000), but $2,000 more than December 2022 ($458,000).

- The average price per square foot in January 2023 was $284.97. This is $5.96 or 2% lower than January 2022 ($290.93) but $4.40 or 1.5% higher than December 2022 ($280.57).

- The median monthly rent for a single-family resale home in Greater Phoenix in January 2023 was $2,200. It was $2,200 in December and November. It was also $2,200 in January 2022.

- According to the most recent Employment Report from the Arizona Commerce Authority, there were 93,700 or 3.1% more nonfarm jobs in December 2022 than December 2021 in Arizona. Month over month (November 2022 to December 2022) there were 400 more jobs.

- The number of foreclosure notices (Notices of Trustee Sales) for residential properties in Greater Phoenix in December 2022 was 293. In December 2021 it was 83. During the real estate crash there were 7,714 in December 2008 and 7,756 in December 2009.

Putting Meaning into the Twelve Metrics

Let us start with #1, weekly accepted contracts. We are in the beginning of the buyer season. The number of weekly accepted contracts is rising! The number of weekly accepted contracts has increased for four consecutive weeks! The 1,367 accepted contracts during the week of January 22, was the highest number of accepted contracts for a week since May 22, when there were 1,439. (See Chart One).

#2 sales or closings this January were low compared to last January. This a direct result of the increase of #3 the 30-year fixed mortgage rate. The 30-year fixed mortgage rate is almost three points higher now than last year at this time. However, the 30-year fixed mortgage has gone down somewhat. According to Freddie Mac, the 30-year fixed mortgage on February 2, 2023 averaged 6.09%. This is the lowest it has been since September 15 when it was 6.02 and almost a percentage point lower than October 27 when it was 7.08. Every little decrease in the rate brings a little increase in sales.

Sellers should expect their homes to sit on the market longer now, than a year ago. In #4, cumulative days on the market have doubled compared to last January.

While #5 total active listings have greatly increased since last year, the number of #6 new monthly listings in January was the lowest number of new monthly listings for a month of January (since the year 2000). The reason for the low number of new monthly listings this January is because many sellers have decided to wait and see what the market does. The low number of January new monthly listings is keeping fairly low #7 the estimated months of supply excluding under contract with backups, which is just over three months.

The three months of estimated supply seems to be a contributing factor to the stopping or slowing the decrease in #8 the overall median purchase price (MPP). The overall MPP which decreased for seven consecutive months, from May to December, slightly went up in January. It increased by $2,000. Also #9 the average price per square foot was slightly higher in January over December.

#10 median monthly rent for a single-family resale home has stalled out in the last three months at $2,200 (November, December, January).

Why the 2023 Residential Market is not the 2008 / 2009 Residential Market

There is speculation that the residential market may be heading into a crash like the years 2008 and 2009. Currently, my answer is no! Why? Because of these factors: employment, foreclosure notices, home equity, and ratio of sales to listings. In #11, the Employment Report shows that there are 93,700 more people with a job in December 2022 than December 2021. If you have a job, you most likely can make your mortgage payment and are not going to get a foreclosure notice. #12 Foreclosure Notices are almost nonexistent. (See Chart Two). In December 2022 there were 293. Compare 293 to the 7,714 in December 2008 and 7,756 in December 2009. Back in 2008 and 2009, thousands of homes flooded the market, spiraling down home values. But at this time in 2023, even if someone receives a foreclosure notice, they likely have equity in the home, and will sell it, for a profit, before it goes to auction. Unless, of course, the homeowner recently purchased their home, they may not have equity. The ratio of January 2023 sales to January 2023 listings is low. For every sale (2,787) in January 2023, there were 1.7 new listings (4,725). This is a low ratio of sales to listings. Now let us compare the ratio of sales to new monthly listings for January 2008. In January 2008 for every sale (2,024) there were 5.75 new monthly listings (11,638). This high number of listings to sales created a downward spiral of home values.

Now you may hear that foreclosure notices in the last year have increased by 253%! This makes for a headline to sell news. If I compare the 83 foreclosure notices in December 2021 to the 293 in December 2022 there is an increase of 253%, but the actual number of foreclosure notices is so small that it is insignificant.

Now, we may have a recession. If we do, hopefully a mild one. There was a slowdown in month-over-month employment according to the Arizona Commerce Authority…only an increase of 400 jobs. I am sure you have heard news of companies laying off workers. If we do have a recession, the thirty-year fixed mortgage rate will likely drop, which will likely create a surge of homebuyers amongst those who are employed.

Overall, the metrics do not show or even suggest a return to the 2008 / 2009 residential market.

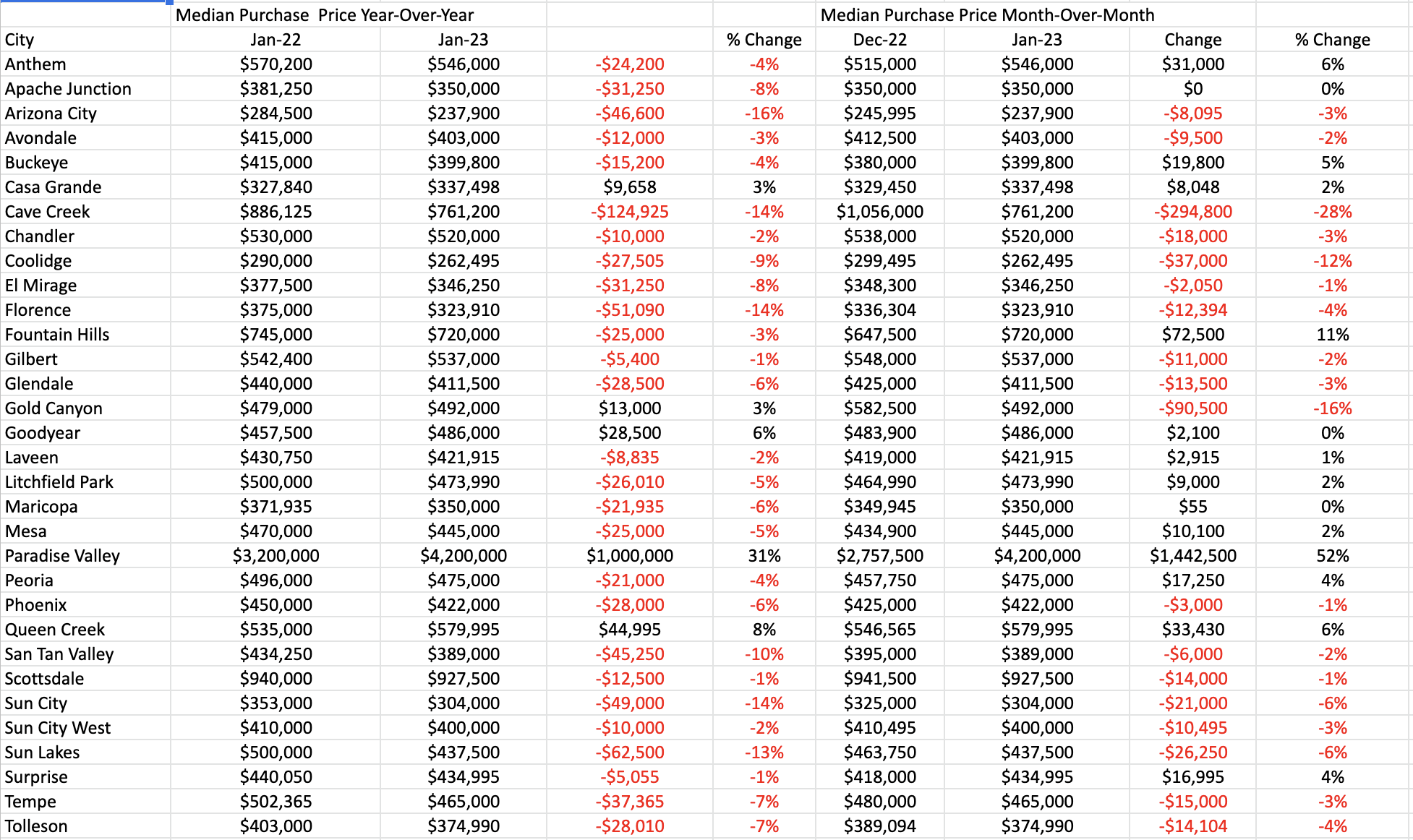

Median Purchase Price for Thirty-Two Cities

Chart One compares the median purchase price (MPP) month-over-month (MoM) and year-over-year (YoY) for thirty-two cities located in either Pinal or Maricopa Counties. YoY the MPP decreased in 26 cities, 5 had increases and one city had no change. MoM the MPP decreased in 18 cities, 13 had increases and one city had no change.

Chart One: Accepted Contracts by Week. The Wilcox Report™

Chart Two: Foreclosure Notices Nowhere Near 2008 / 2009 Levels

Table One: January 2023 Results for Thirty-Two Cities by The Wilcox Report™